Fix-and-Flip Strategy for Treasure Valley: Neighborhood Opportunity Analysis for 2025

Thinking About Flipping Homes in Idaho? Here’s Where and How to Win in the Treasure Valley

If you’re looking to start or scale a fix-and-flip strategy in the Treasure Valley, the timing has never been better. Despite rising costs in labor and materials, the Boise metro and surrounding markets like Nampa, Caldwell, Kuna, and Middleton continue to offer strong margins for well-executed renovations.

The key? Knowing where to buy, what to fix, and how to price.

In this guide, I’ll give you a location-specific playbook for flipping homes in 2025, including which neighborhoods still have upside, where to avoid overbuilding, and what types of properties are in highest demand.

Let’s get into it.

Understanding the Treasure Valley Flip Market in 2025

Market Conditions for Flippers Right Now

In 2025, we’re seeing:

-

A return to normalized appreciation (3–5% YoY)

-

Fewer bidding wars, but strong demand for move-in ready homes

-

Buyers increasingly willing to pay for upgrades—if they’re done right

-

Older inventory from the early 2000s or pre-1980s hitting the market needing cosmetic updates or full gut jobs

The fix-and-flip sweet spot right now is the $375K–$575K resale price point, particularly in the first-time and move-up buyer categories.

Best Neighborhoods and Cities for Fix-and-Flip in the Treasure Valley

1. Boise Bench (83705 & 83704)

Why it works:

The Bench is one of the last remaining pockets of Boise where you can find homes under $400K with major upside. Many were built in the 1950s–1970s and need cosmetic updates, new roofs, and HVAC replacements. It’s close to downtown, BSU, and the airport—making it highly rentable or flippable.

Target Properties:

-

3-bed, 2-bath ranchers with unfinished basements or old kitchens

-

Homes on larger lots with alley access (potential for ADU in future)

Flipper Caution:

Avoid overpricing past $525K without adding square footage or garage space. Stay under the appraised comps.

2. West Boise (83713 & 83704)

Why it works:

This area is full of 1990s–2000s homes that are structurally sound but dated inside. Paint, floors, kitchens, and lighting go a long way. It’s a great place to “mid-flip”—not a gut job, but a serious refresh.

Target Properties:

-

Homes between 1,400–2,200 sq ft

-

Subdivisions with decent curb appeal but no HOA or low fees

Flipper Tip:

Install LVP flooring, swap out oak for white shaker, and don’t forget recessed lighting. Buyers here value function over luxury.

3. Nampa North & Central (83686 & 83687)

Why it works:

Nampa offers the best ROI potential right now due to low purchase prices and surging buyer demand. First-time buyers and investors love this area, especially for homes under $400K. You can buy homes needing $40K–$60K in work and still stay under $325K all-in.

Target Properties:

-

Homes built pre-1990 with deferred maintenance

-

Larger lots near Lake Lowell or downtown Nampa

Neighborhoods to Consider:

-

Karcher Rd corridor

-

Roosevelt & 12th Ave S area

-

Near Northwest Nazarene University

Avoid:

Rural fringe areas with septic systems unless you're experienced.

4. Caldwell (83605 & 83607)

Why it works:

Caldwell is Idaho’s “sleeper market.” It has one of the lowest price-per-square-foot metrics in the Valley but rising demand due to wineries, Greenbelt expansion, and downtown revitalization.

Target Properties:

-

Historic homes that need updates but retain charm

-

Small 2-bed/1-bath homes that can be converted to 3/2

Watch Out For:

Foundation issues in older homes. Always do a structural inspection.

Value Add Opportunity:

Look for zoning overlays or lots large enough for ADU potential. Caldwell is warming up to this.

5. Kuna & Middleton (83634 & 83644)

Why it works:

These markets are newer to the flip scene but present unique value: newer homes (2005–2012) that are slightly dated and can be resold at a premium with minimal cosmetic changes. Think “lipstick flips.”

Target Properties:

-

Builders like CBH or Hubble with builder-grade finishes

-

Homes that need paint, flooring, landscaping, and staging—not full remodels

Flipper Warning:

These buyers are rate-sensitive and shopping new construction. Make sure your finished product feels new (even if it isn’t).

What to Fix (And What to Skip)

High-Impact Fixes

✅ Kitchen cabinet paint or replacement

✅ New quartz or granite countertops

✅ LVP flooring in common areas

✅ Fresh paint inside and out

✅ Updated lighting + fans

✅ Modern tile in bathrooms

✅ New vanities and mirrors

✅ Front yard landscaping + bark

Low-ROI Fixes (Think Twice)

🚫 Solar panels (in most flips)

🚫 Full tear-out of walls unless necessary

🚫 Converting garages or adding square footage unless ROI is clear

🚫 Pool installs—just don’t

How to Analyze a Flip in the Treasure Valley

Step 1: Know the ARV (After Repair Value)

Use sold comps from the last 90–180 days in the same subdivision or within 0.5 miles. Adjust for:

-

Square footage

-

Lot size

-

Garage bays

-

Year built

-

Renovation level

Be conservative and use the LOWEST likely ARV. Better to be surprised with upside than caught holding.

Step 2: Estimate Renovation Costs

On average in 2025:

-

Paint (full house): $5,000–$7,000

-

Flooring (LVP): $3.50/sq ft installed

-

Kitchen remodel (full gut): $15,000–$25,000

-

Roof replacement: $12,000–$18,000

-

HVAC (furnace + AC): $10,000–$15,000

-

Bathroom remodel: $8,000–$12,000

Use a general contractor or build a trusted team if you plan to do multiple flips per year.

Step 3: Factor in Soft Costs

Include:

-

Holding costs (mortgage, taxes, utilities): $1,500–$2,000/month

-

Realtor fees: 5–6% of resale price

-

Closing costs: 1–2%

-

Builder’s risk insurance

-

Permits (as needed)

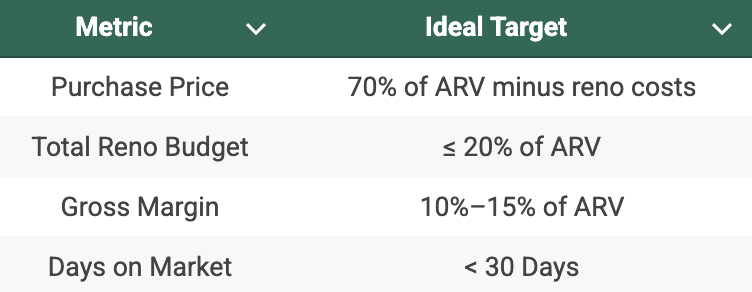

Key Metrics to Track

Tools I Recommend

-

PropStream – for finding off-market distressed leads

-

Zillow + MLS + Redfin – for tracking comps and buyer behavior

-

DealCheck.io – for running numbers

-

GHL or CRM – for investor lead follow-up

-

Boise City/County GIS – for zoning and permit data

Final Thoughts: Flipping Is a Business—Treat It Like One

Flipping homes in the Treasure Valley isn’t about luck. It’s about discipline, local market knowledge, and execution. The best flips are boring—repeatable, scalable, and profit-driven.

Whether you’re just starting or you’ve done dozens, I can help you:

✅ Find profitable properties

✅ Analyze flips before you buy

✅ Connect you with contractors, lenders, or staging companies

✅ Market your finished product for top dollar

📞 Call or Text Curtis at (208) 510-0427

📧 info@chismteam.com

📥 Ready to relocate remotely? Download our Boise Relocation Guide

Categories

Recent Posts